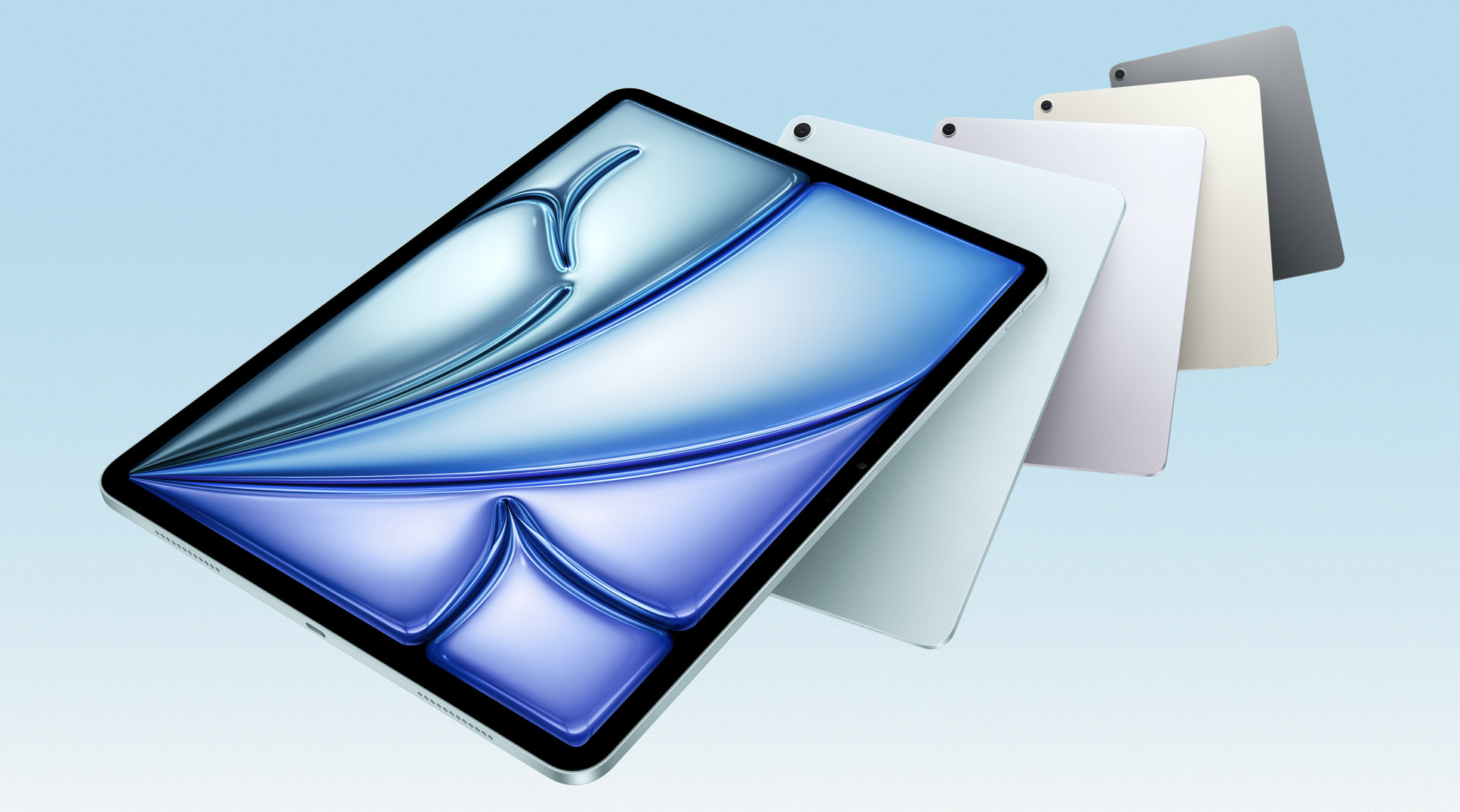

Apple has introduced the latest iPad Air, now equipped with the powerful M3 chip, making it nearly twice as fast as its predecessor. Designed for seamless performance, the new iPad Air is available in two sizes — 11-inch and 13-inch — offering users more flexibility than ever before.

Unveiled on March 4, the new iPad Air is the first-of-its-kind to feature advanced graphics, improved speed, power efficiency, and AI-driven capabilities through Apple Intelligence.

The device supports Apple Pencil Pro, the Magic Keyboard, and iPadOS 18, enhancing its versatility for students, professionals, and creatives alike.

Here’s a look at what’s inside the new device:

The M3 chip delivers 35 per cent faster CPU performance and 40 per cent improved graphics over M1, with hardware-accelerated ray tracing for ultra-realistic gaming and rendering. The Neural Engine is now 60 per cent faster, unlocking smarter AI features across apps.

Built for Creativity and Productivity

Designed for versatility, the new iPad Air supports Apple Pencil Pro, the all-new Magic Keyboard, and iPadOS 18. The 13-inch model provides more screen space, while the 5G connectivity and enhanced cameras ensure seamless remote work and content creation.

Supercharged performance with M3

iPad Air with M3 empowers users to be productive and creative wherever they are, from aspiring creatives using demanding apps and working with large files, to travelers editing content on the go.

Get smarter with Apple Intelligence

Apple Intelligence delivers helpful and relevant intelligence. In Photos, the Clean Up tool makes it easy to remove distracting elements in images, and natural language search allows users to search for just about any photo or video by simply describing what they are looking for.

With Image Wand in the Notes app, users can make notes more visually engaging by turning rough sketches into delightful images, just by drawing a circle around the sketch with their Apple Pencil.

Users can even circle empty space within a note, and Image Wand will gather context from the surrounding area to create a relevant image that complements the note and makes it more visual.

Things go faster with ChatGPT

With ChatGPT seamlessly integrated into Writing Tools and Siri, users can tap into ChatGPT’s expertise without jumping between applications, so they can get things done faster and easier than ever before

The latest software update introduces:

- Math Notes for real-time equation solving

- Smart Script for refined handwritten notes

- Audio transcription for searchable recordings

- Redesigned Control Center for quick access

Siri now integrates ChatGPT, letting users access AI-powered assistance without switching apps.

Pricing and Availability

Pre-orders began on March 4, with availability from March 12.

(Source: apple.com)